Aurora Energy

Metals Project

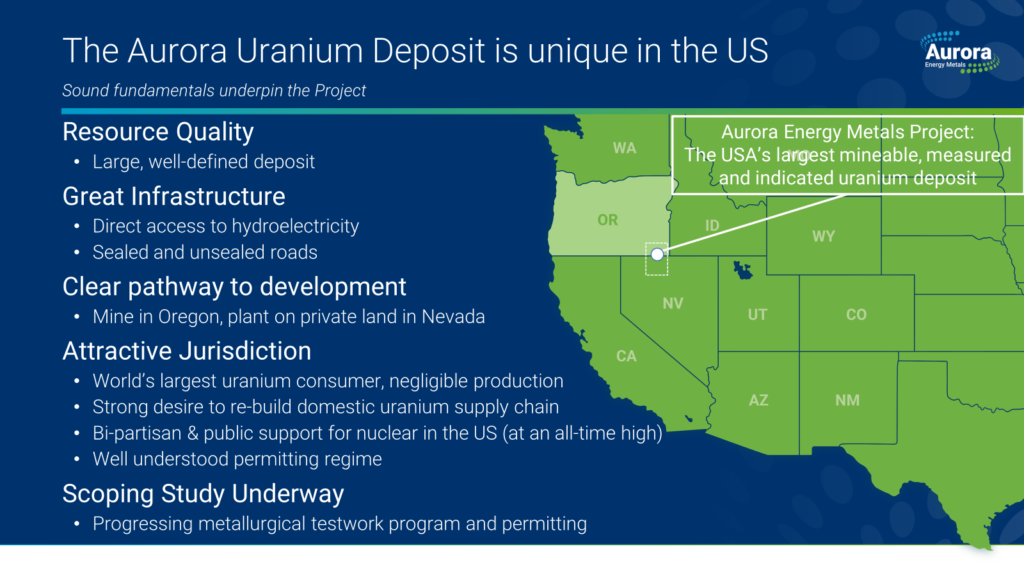

The Company’s flagship project, the Aurora Energy Metals Project (AEMP), is located in southeast Oregon in the United States.

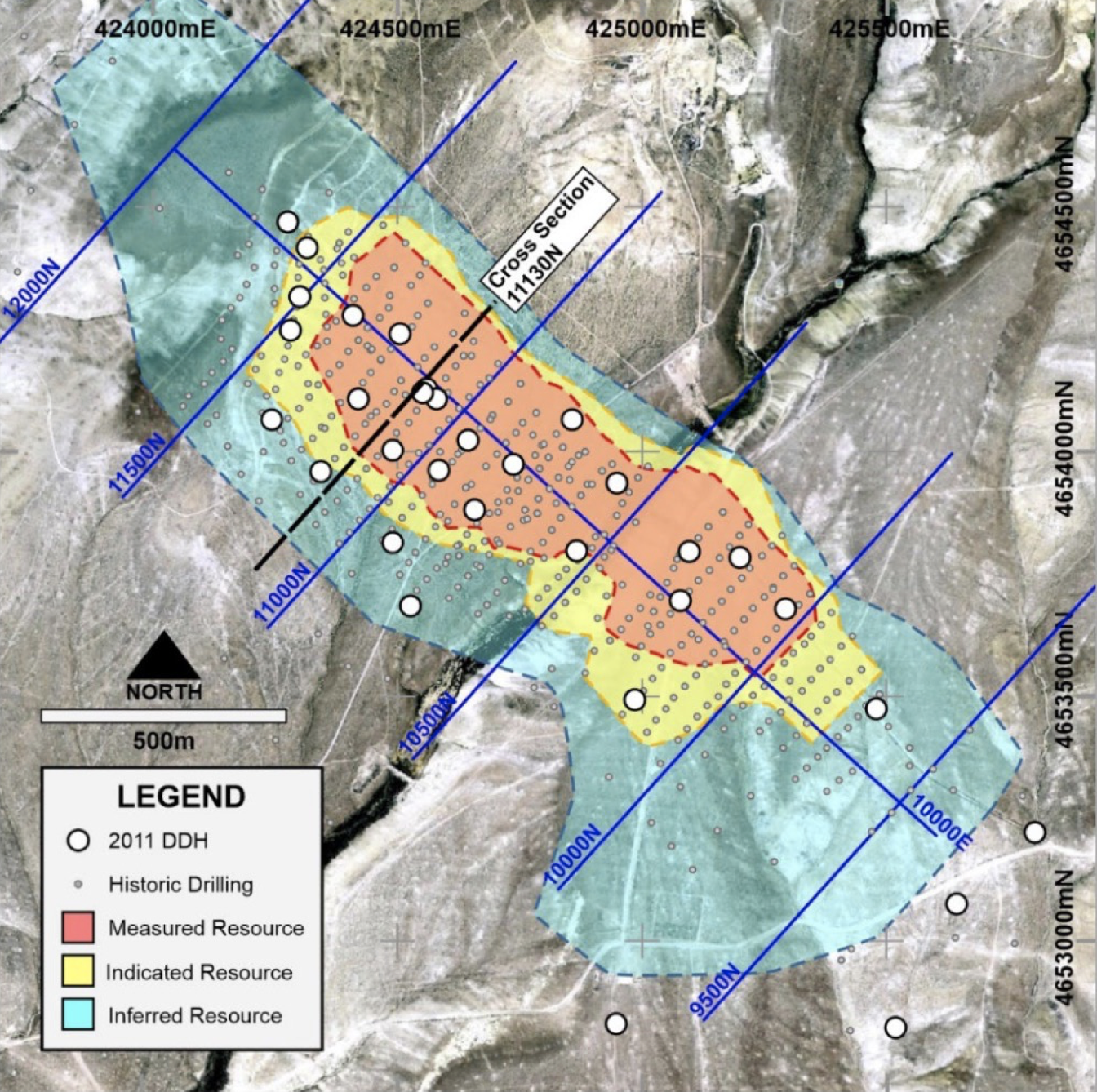

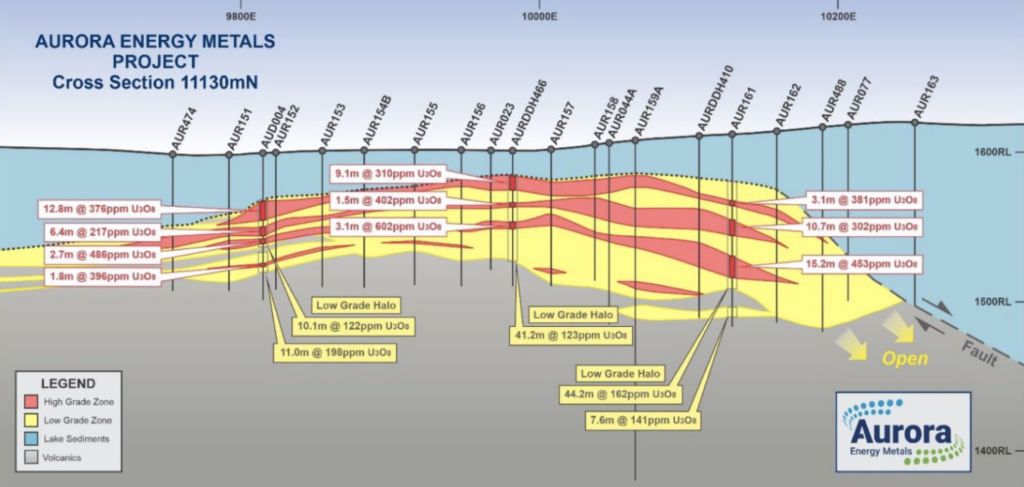

AEMP contains a well-defined, significant Uranium Mineral Resource in shallow volcanics, with high grade concentration at unconformity with overlying lake sediments.

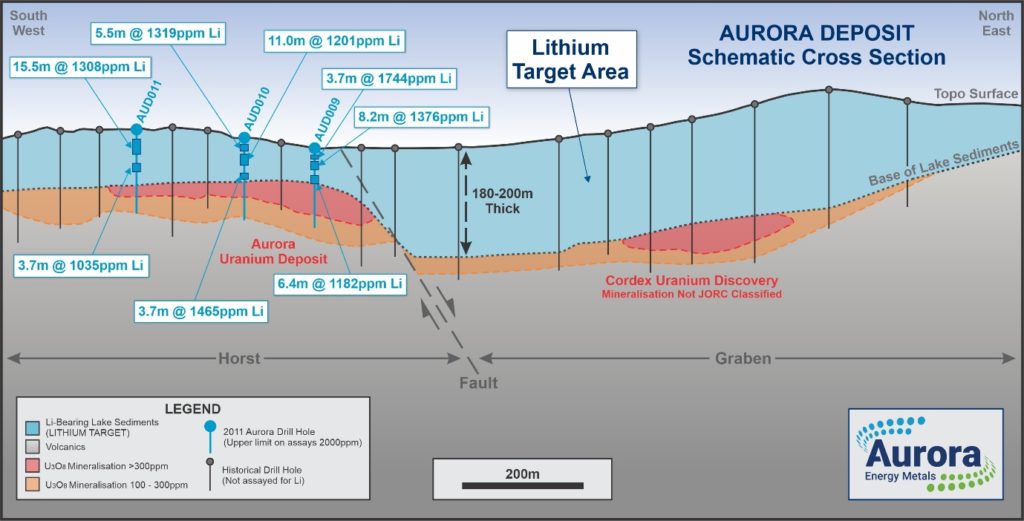

Multiple, thick intercepts of lithium mineralisation (20m @ 1044ppm Li, 15.5m @ 1308ppm Li) have also been identified in the lake sediments.

The Company believes there is potential for two geologically separate deposits to be delineated and developed, providing economies of scale.

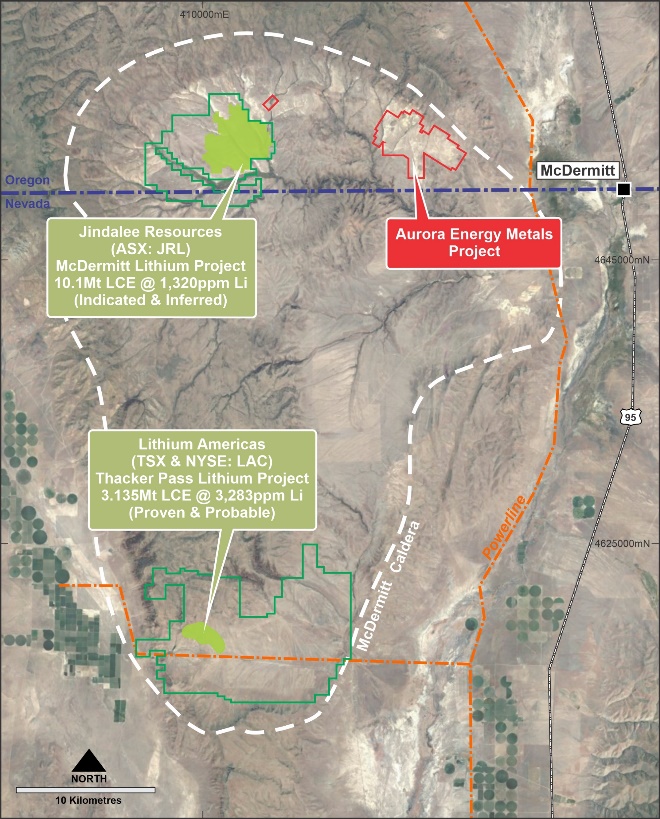

The Li bearing sediments are similar to projects in the region, including Jindalee Resources’ McDermitt Li Project (Indicated & Inferred MRE 1.43Bt at 1,320ppm Li for 10.1Mt LCE).

AEMP – Uranium

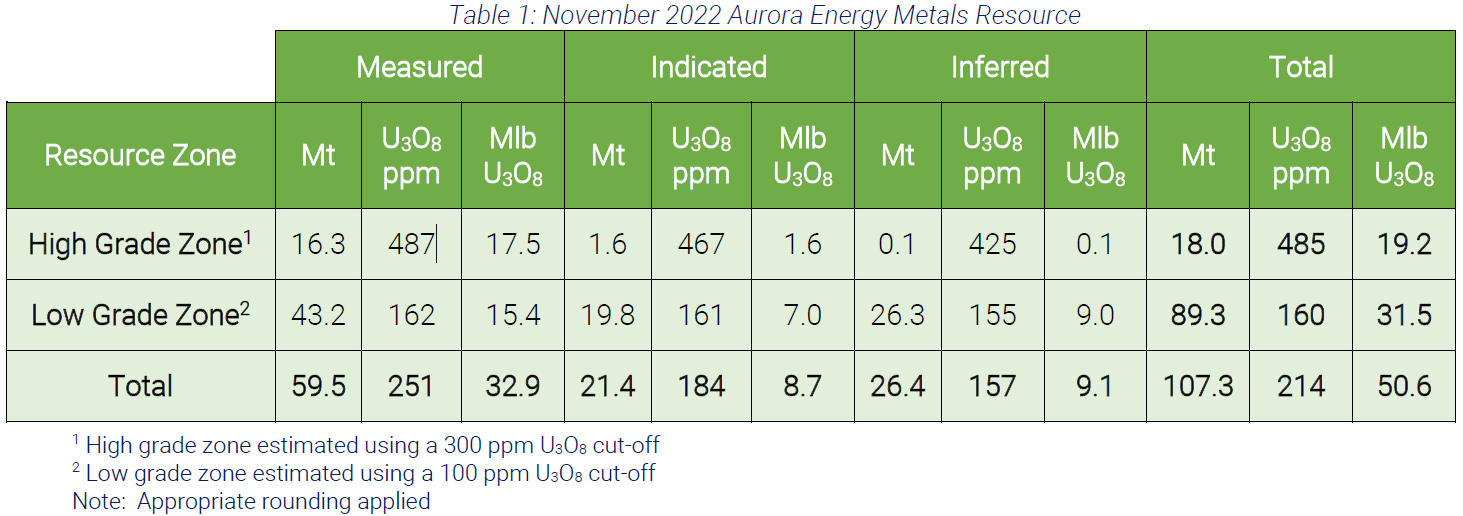

The Company continues to advance the Scoping Study on its flagship AEMP. The AEMP’s shallow, high-grade core (18Mt @ 485 ppm U3O8 for 19.2Mlb U3O8, 99.5% being in the JORC Measured and Indicated categories), is the key to the Project’s development strategy of a conventional open pit operation in Oregon with a processing plant located on Aurora owned private land in Nevada, close to an existing hydroelectricity supply. The Company is aiming to release the results of the Scoping Study in April.

Potential Uranium Mining Scenario

Based on an updated Mineral Resource estimate of 50.6Mlb U3O8 at 214 ppm eU3O8 (including a higher-grade upper core of 18Mlb at 485ppm eU3O8, the Company anticipates a scenario involving a shallow, low strip ratio open pit operation mining and processing 2-3Mtpa of ore for the production of 2Mlb U3O8 per annum over a mine life of 8-12 years.

Further details on the Mineral Resource Estimate can be found here.

Next steps

There is potential to extend the Aurora Uranium Deposit for the Aurora Energy Metals Project to the north-west and also to the north-east down into the horst-graben structure which is interpreted to be an important conduit for the uranium bearing mineralising fluids. Drilling of this zone and the overlying lithium-bearing sediments is underway and results will be announced in the coming few months.

In addition, Aurora has compiled historic uranium drilling data from Cordex for the graben block immediately to the north-east of the defined Aurora Uranium Deposit. These 112 holes not only show uranium zones in the underlying volcanics, but along with the extensive Placer and EVE drilling data, add significant understanding to the architecture and thickness of the overlying lake sediments that potentially may host significant lithium mineralisation. Uranium mineralisation in this zone is not included in the current resource. This data has been utilised to plan further drilling which is currently in the permitting phase and expected to start in 2023.

AEMP – Lithium

A unique feature of AEMP is the potential for the project to generate two income streams from commodities in different geological horizons. Whilst uranium mineralisation is generally hosted in the volcanics, there is the potential for the definition of lithium mineralisation in the overlying lake sediments.

A number of drillholes have been assayed for lithium, with results including 15.5m @ 1308ppm Li, 11m @ 1201ppm Li and 8.2m @ 1376ppm Li returned.

The region has previously been prospective for lithium, producing mineral resources for Lithium Americas at Thacker Pass and Jindalee Resources at its McDermitt Project..

AEMP – Right Place, Right Time

The AEMP is located in Oregon, in a location that has significant infrastructure in place to facilitate development. With a growing nuclear industry in the US, a lack of US uranium production and a constrained global supply Aurora is well placed to become a reliable domestic supplier of choice.